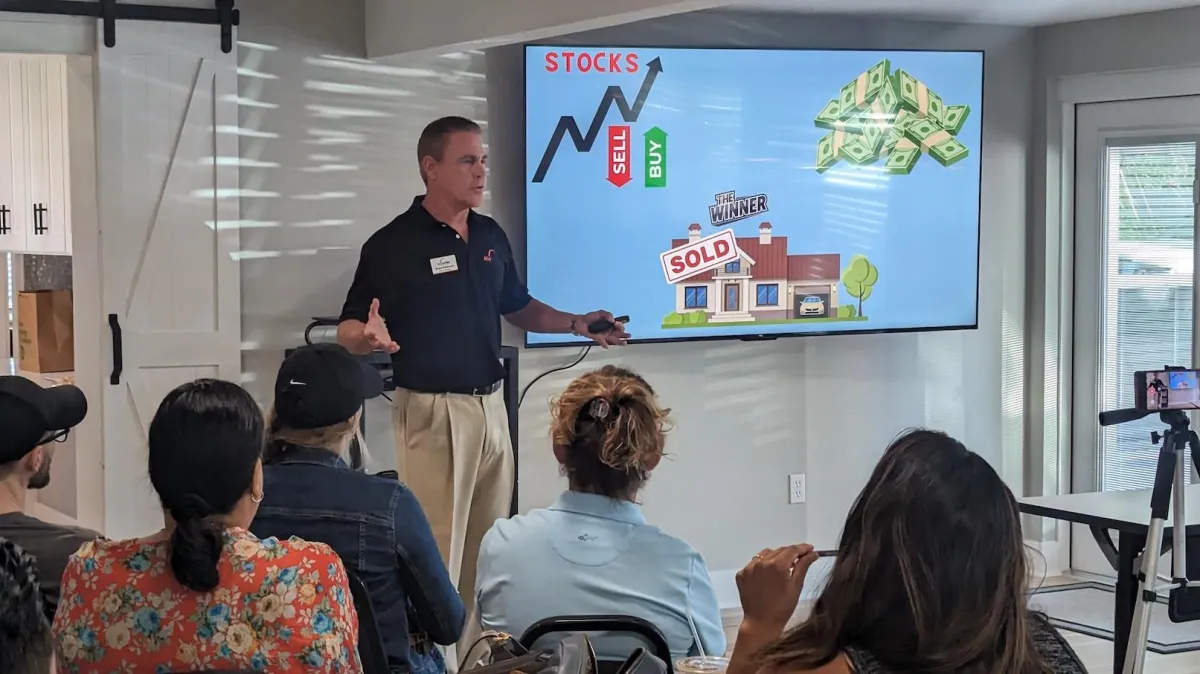

The Truth About Mortgages:

Don’t Let Big Banks Overcharge You!

Big banks make mortgages confusing—so they can charge you more. Learn the insider secrets to securing the lowest rates and avoiding costly mistakes with expert guidance from 20 Year Veteran Rayce Robinson.

Watch Now to Save Thousands on Your Mortgage!

Welcome to Mid Florida Mortgage Professionals

Buying a home or refinancing shouldn’t feel overwhelming. At Mid Florida Mortgage Professionals, we believe in simplifying the process, educating our clients, and delivering competitive loan solutions — all while providing a level of personal attention that big banks simply can’t match.

Whether you're purchasing your first home, upgrading, investing, or refinancing, you deserve confidence in every step of the mortgage journey. We’re here to help you plan, qualify, and close smoothly with the right loan — not just the easiest one.

How We Work

Our Four-Step Approach

Initial Consultation

We listen first. What are your goals? What’s your timeline? We’ll map it out together.

Loan Options & Roadmap

We review the types of loans that match your needs, walk through the process, and answer your questions.

Application & Processing

We guide you through the paperwork, documentation, and underwriting so you feel informed and confident.

Closing & Beyond

We aim for a smooth closing, then stay available post-closing. Your home financing is a milestone – not the end of our relationship.

WHY WORK WITH RAYCE ROBINSON & HIS TEAM?

Local Florida Mortgage Experts

Deep knowledge of Florida markets, lending programs, and financing strategies.

More Loan Options

As a mortgage broker, we shop multiple lenders on your behalf to secure competitive terms and the best fit for your goals.

Custom Financial Solutions

Whether you're a first-time buyer, upgrading, downsizing, or investing, we customize loan strategies to fit your unique financial situation.

Fast, Efficient Pre-Approvals

Speed matters in today’s market — get pre-approved quickly and confidently.

Guidance & Communication

We guide you through each step, explain your options clearly, and make sure you’re never left wondering what's next.

Trust & Relationships First

Clients refer their friends and family because they know we care — and we deliver 5 Star service.

Today's Florida Mortgage Rates

Disclaimer: The mortgage interest rates shown are for informational purposes only and are subject to change without notice. Actual rates and terms may vary based on individual credit profile, loan amount, property type, occupancy, loan-to-value (LTV), and other factors. Not all applicants will qualify for the lowest rates. Rates displayed may be provided by third-party sources and may not reflect current market conditions or all available loan programs. Please contact us directly for a personalized rate quote and to confirm current pricing and eligibility.

WHAT OUR CLIENTS SAY

Our clients are at the center of everything we do. Their experiences reflect our dedication to clear guidance, trusted mortgage expertise, and a home-financing experience built around care and understanding.

Find Out How Much

Your Home is Worth!

Enter your address above to instantly view the estimated value of your home

Frequently Asked Questions

What type of home loans do you offer?

We offer Conventional, FHA, VA, USDA, Jumbo, refinance options, and reverse mortgages. Our team will help you choose the loan program that best fits your goals and financial situation.

How do I get pre-approved for a home loan?

You can start by completing our secure online application or reaching out to us directly. We’ll review your finances and provide a pre-approval letter to help strengthen your offer when shopping for a home.

What documents do I need to apply?

Typically, you’ll need recent pay stubs, W-2s or tax returns, bank statements, and a valid ID. If you’re self-employed, additional documentation may be required. We’ll walk you through it step-by-step.

Should I find a house first or apply for a mortgage first?

We recommend applying first. A pre-approval tells you exactly what you qualify for and helps you shop with confidence. Once you find the right home, you're already ahead of the process — and sellers are more likely to accept your offer.

How much do I need for a down payment?

Down payments vary by loan program — some programs allow as little as 3% down, and VA loans may require no down payment for eligible borrowers. We'll help you determine what’s right for you.

What’s the difference between pre-qualification and pre-approval?

Pre-qualification is an estimate based on self-reported info. Pre-approval verifies your income, credit, and finances — giving you stronger buying power. We recommend getting pre-approved first.

Do you work with first-time homebuyers?

Yes! We love guiding first-time buyers. We’ll help you understand your options, available programs, and the full loan process from start to finish.

What are closing costs and what should I expect?

Closing costs typically range from 2%–5% of the home price and include lender fees, title, appraisal, and other services. We’ll review everything with you so there are no surprises.

How long does the mortgage process take?

Most loans close in about 25–30 days, depending on the loan type and documentation. We keep communication clear to help you close on time.

Can I refinance my current mortgage with you?

Yes. Whether you want a better rate, a lower payment, or to access equity, we’ll help you explore refinancing options and see if it makes financial sense.

Still have questions?

We’re here to help!

Contact Info

We’re here to make your home financing experience smooth and stress-free. Contact our team anytime — we’re ready to guide you through every step of your homebuying journey.

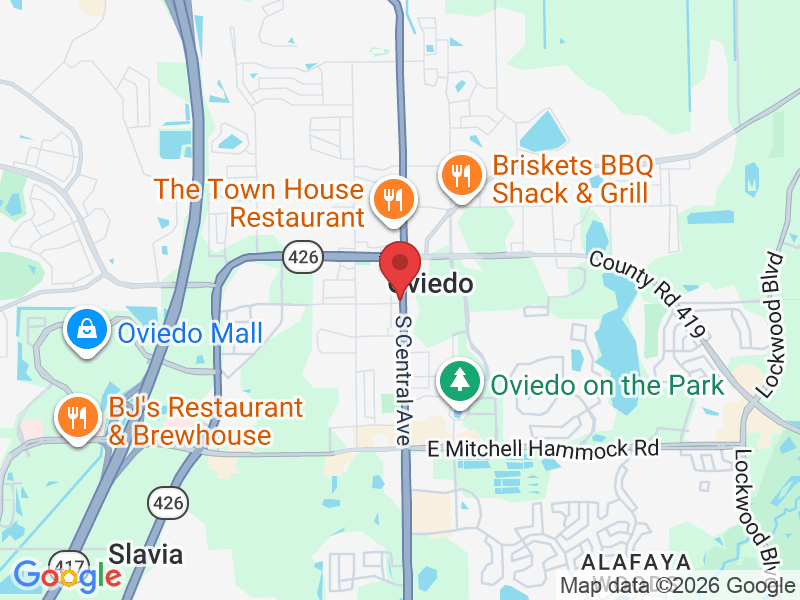

Location

235 S Central Ave, Oviedo Florida 32765

Phone

Mid Florida Mortgage Professionals

Company NMLS# 1587074

Rayce Robinson

LO NMLS # 322615

235 South Central Ave

Oviedo, Florida 32765

© 2026 Mid Florida Mortgage Professionals. All rights reserved. Mid Florida Mortgage Professionals is not affiliated with any government agencies. This is not an offer to enter into an agreement. Not all customers will qualify. Information, rates and programs are subject to change without notice. All products are subject to credit and property approval. Other restrictions and limitations may apply. Equal Housing Opportunity. NMLS Consumer Access